In the world of options trading, the long strangle strategy is a powerful tool for traders looking to capitalize on market volatility. Whether you’re a seasoned trader or just starting out, understanding how to place a long strangle option on Webull can open up new opportunities for profit. This guide will walk you through everything you need to know about the long strangle strategy, from the basics to advanced tips, and how to execute it on the Webull platform.

What is a Long Strangle Options Strategy?

A long strangle is an options trading strategy that involves buying both a call option and a put option on the same underlying asset, with the same expiration date, but with different strike prices. The call option has a higher strike price, while the put option has a lower strike price. The goal of this strategy is to profit from significant price movements in either direction, making it an ideal strategy for volatile markets.

Why Use a Long Strangle Strategy?

The long strangle strategy is particularly useful in situations where you expect a large price movement in the underlying asset but are unsure of the direction. This could be due to an upcoming earnings report, a major news event, or other market-moving catalysts. By purchasing both a call and a put option, you position yourself to profit whether the price moves up or down.

Key Components of a Long Strangle

- Call Option: This gives you the right to buy the underlying asset at a specified strike price before the option expires.

- Put Option: This gives you the right to sell the underlying asset at a specified strike price before the option expires.

- Strike Prices: The call option will have a higher strike price, while the put option will have a lower strike price.

- Expiration Date: Both options must have the same expiration date.

Advantages of the Long Strangle Strategy

- Unlimited Profit Potential: If the price of the underlying asset moves significantly in either direction, the profit potential is theoretically unlimited.

- Limited Risk: The maximum loss is limited to the total premium paid for both options.

- Flexibility: You can profit from both upward and downward price movements.

Disadvantages of the Long Strangle Strategy

- High Premium Costs: Since you are buying both a call and a put option, the total premium cost can be high.

- Time Decay: Options lose value as they approach expiration, so the strategy is less effective in stable or low-volatility markets.

- Break-Even Points: The price of the underlying asset must move significantly in either direction to reach the break-even point.

How to Place a Long Strangle Option on Webull

Now that you understand the basics of the long strangle strategy, let’s dive into how to place a long strangle option on Webull. Follow these step-by-step instructions to execute the strategy effectively.

Step 1: Open a Webull Account

If you don’t already have a Webull account, you’ll need to sign up and fund your account. Webull offers a user-friendly platform with advanced trading tools, making it an excellent choice for options traders.

Step 2: Navigate to the Options Trading Section

Once your account is set up and funded, navigate to the options trading section on Webull. You can do this by selecting the “Trade” tab and then choosing “Options.”

Step 3: Select the Underlying Asset

Choose the underlying asset you want to trade. This could be a stock, ETF, or index. Make sure to select an asset that you expect to experience significant price movement.

Step 4: Choose the Expiration Date

Select the expiration date for your options. Remember, both the call and put options must have the same expiration date.

Step 5: Select the Strike Prices

Choose the strike prices for your call and put options. The call option should have a higher strike price, while the put option should have a lower strike price. The difference between the strike prices will determine the potential profit and risk of the strategy.

Step 6: Place the Orders

Place an order to buy the call option and another order to buy the put option. Make sure to review the premium costs and ensure that you are comfortable with the total investment.

Step 7: Monitor Your Position

Once your long strangle position is open, it’s essential to monitor the market and the price of the underlying asset. Be prepared to adjust your strategy if necessary, depending on how the market moves.

Step 8: Close Your Position

When the price of the underlying asset moves significantly in either direction, you can close your position by selling the call or put option. Alternatively, you can let the options expire if they are out of the money.

Tips for Success with the Long Strangle Strategy

- Choose the Right Underlying Asset: Look for assets with high volatility or upcoming catalysts that could cause significant price movements.

- Manage Your Risk: Be aware of the total premium cost and ensure that you are comfortable with the potential loss.

- Monitor the Market: Keep a close eye on the market and be prepared to adjust your strategy if necessary.

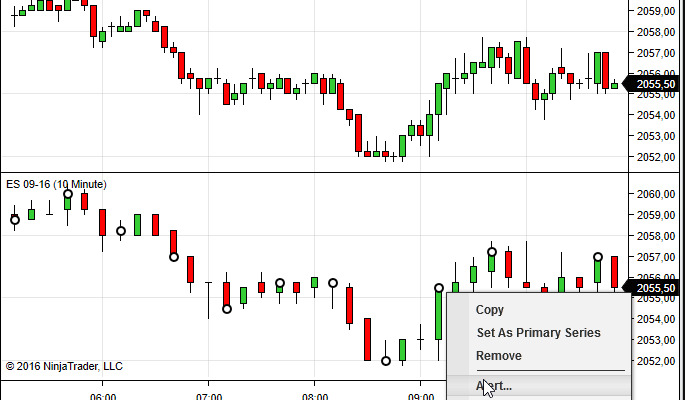

- Use Technical Analysis: Use technical indicators and chart patterns to identify potential entry and exit points.

- Practice with Paper Trading: If you’re new to options trading, consider practicing with paper trading before committing real money.

Common Mistakes to Avoid

- Overlooking Premium Costs: The total premium cost can be high, so make sure to factor this into your risk management.

- Ignoring Time Decay: Options lose value as they approach expiration, so be mindful of the time decay effect.

- Failing to Monitor the Market: The long strangle strategy requires active monitoring to maximize profits and minimize losses.

Advanced Strategies: Combining the Long Strangle with Other Strategies

Once you’ve mastered the basics of the long strangle strategy, you can explore advanced strategies that combine the long strangle with other options strategies. For example, you could use a long strangle in conjunction with a straddle or a butterfly spread to create a more complex trading strategy.

Conclusion: Mastering the Long Strangle Strategy on Webull

The long strangle options strategy is a powerful tool for traders looking to profit from significant price movements in volatile markets. By understanding the basics of the strategy and following the step-by-step instructions for placing a long strangle option on Webull, you can position yourself for success in the options market. Remember to manage your risk, monitor the market, and continuously refine your strategy to maximize your profits.